Featured

Thinking of Timing the Market?

Volatility is back and so is the idea of timing the market. The sustained rally that produced 30%+ gains in the S&P 500 in 2019 and continued into 2020 came to an abrupt halt in late February, when fears of the new coronavirus epidemic and its effects on the economy swept Wall Street and beyond. Markets across the globe plummeted, and the Dow Jones Industrial Average dropped over 1,000 points in one day. More drops followed, and volatility has ensued as investors try to grapple with the spreading epidemic and its potential impact on trade, travel, and the global economy.

The Futility of Market Timing

The situation presents a tempting scenario for timing the market — those who try to predict when stock prices will rise and fall. Should you sell before it gets worse? Should you buy while prices are down? What about parking your money in bonds until the epidemic runs its course?

While timing your purchases and sales to capitalize on the market’s ups and downs may seem to make sense in theory, it’s extremely difficult to pull off successfully. Typically, you can’t accurately pinpoint a market high or low point until after it has occurred. If you move your money out of stocks during a low period, you might not move your money back in time. By the time you realize stocks are on an upswing, it may be too late to take advantage of gains.

In fact, history has shown that trying to time the market’s ups and down is a loser’s game. Even the experts, with their analytical prowess and sophisticated computer models, cannot manage to consistently beat the market. A landmark study by CXO Advisory Group tracked more than 4,500 forecasts by 28 self-described market timers between 2000 and 2012. Only 10 were able to accurately forecast equity returns (as measured by the S&P 500) over 50% of the time, and none were able to predict accurately enough to outperform the market.1 Nobel Laureate William Sharpe calculated a market timer would have to be correct 74% of the time — on both the market decline and recovery — to outperform another investor who just lets their money sit in a passive portfolio of comparable risk.1

Dealing with crises such as the coronavirus epidemic requires patience and a level head. Here are some suggestions to help you weather the storm:

Don’t panic. Selling into a plunging market is often a sure way to lock in a loss. Talk with a financial advisor before you act. He or she can help you separate emotionally driven decisions from those based on your goals, time horizon, and risk tolerance. Researchers in the field of behavioral finance have found that emotions often lead investors to read too much into recent events even though those events may not reflect long-term realities. With the aid of a financial professional, you can sort through these distinctions, and you’ll likely find that if your investment strategy made sense before the crisis, it will still make sense afterward.

Consider Time in Market Instead. Clearly, time can be a better ally than timing. Instead of trying to time the market, you may be better off with a well-coordinated investment strategy based on your personal risk tolerance and time frame. While past performance is no guarantee of future results, the stock market has always recovered from every downturn.

So think twice before trying to time the market’s dips and corrections, and work with your financial advisor to ensure that the investments you select are in keeping with your goals.

Source/Disclaimer:

1Source: Index Fund Advisors, Inc. (IFA.com), 2014. Based on a study by CXO Advisory, © CXO Advisory Group LLC.

Deciding When to Start Taking a Pension

Most businesses today do not offer a pension plan. But pensions are still a common benefit for teachers, federal employees, and others who work in the public sector. Many grandfathered private-sector plans also still exist. In fact, according to the Bureau of Labor Statistics, over 30 million public and private sector American workers participate in a pension plan.1

For those fortunate enough to have a workplace pension, one of the critical decisions you’ll need to make is when to begin collecting. Although payments typically begin at age 65, many plans allow you to start collecting your retirement benefits as early as age 55. But if you decide to start receiving benefits before you reach full retirement age, the size of your monthly payout will be less than it would have been if you’d waited. So the question is: when is the optimal time to start, so that you maximize your total payments?

Unfortunately, there is no simple answer. What works best for you will depend upon a number of different factors. Here are some points you’ll want to consider before deciding.

Longevity. The longer you live, the better off you will be by delaying your pension payments. Although nobody can pinpoint exactly how long they will survive, they may be able to make a guesstimate. Today’s newborns have an average life expectancy of close to 79 years. A man who reaches age 65 has a life expectancy of about 83; a woman, about 86. Those in good health with a family history of longevity stand a good chance of exceeding these figures. What’s more, medical advances have helped increase these averages over time. As a result, many people today can look forward to retirements of 30 years or longer.

Specific terms of the pension plan. The terms of a pension vary widely from plan to plan. A typical pension plan’s payout depends on years of service. So your timing may depend on when you hit a threshold year. Other factors affect payout, such as whether overtime and bonuses count toward your payout or if benefits are capped at a certain percentage of salary. Many plans also offer cost-of-living adjustments (COLAs). So make sure to check the terms of your specific plan.

Is the pension safe? Although there are federal and state laws that seek to ensure that a given pension plan meets all its payment obligations, there is no guarantee that that will be the case. Pension plan defaults have been rare, but no pension plan is bulletproof. If a local government entity or private corporation falls on hard times, it could affect pension payouts. It’s no secret that many large public plans are underfunded. Some estimates put the collective shortfall in the trillions. Whether such underfunding will eventually reduce benefits in a particular plan is anyone’s guess. But the upshot for prospective pensioners is that it may not be wise to pin all your retirement hopes on one pension plan.

Personal circumstances. Everyone has individual needs and financial situations. You may have other sources of retirement income — Social Security, an individual retirement account (IRA), a 401(k) plan, or other retirement savings. You may also plan to cash in on a home or other real estate to help fund your retirement. Or, you may have a spouse with his or her own pension plan. Whatever your circumstances, be sure to factor them into your decision.

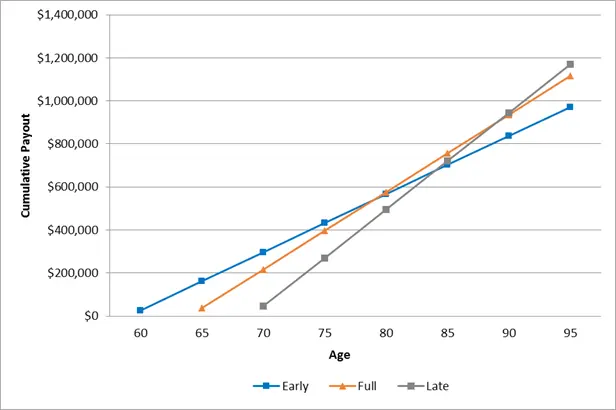

Compare Cumulative Payouts2

The following chart shows the cumulative payments of a hypothetical pension plan, for early (age 60), full (age 65), and late (age 70) start times. It assumes a pension of $3,000 per month or $36,000 per year at full retirement age; that payments are fixed, with no COLA increases; and that the pension decreases 5% for each year of early retirement and increases 5% for each year of late retirement (until age 70).

Note where the lines cross each other. An early start will result in the highest cumulative benefit until you hit age 80. After that point, “full” timing begins to net a higher cumulative payout. And if you opt to wait until age 70, your cumulative benefit won’t outpace a full benefit until you reach age 90.

Keep in mind that this example is for illustration purposes and may differ from your actual experience. Talk with a financial advisor who can help you decide when is the best time to start taking your pension payouts.

Notes

1Bureau of Labor Statistics, National Compensation Survey for 2018.

2Illustration is hypothetical. Your plan will differ.

Tips to Help Lower Your Tax Bill with Year-End Planning

As the end of the year draws near, the last thing anyone wants to think about is taxes. But if you are looking for ways to minimize your tax bill, there’s no better time for tax planning than before year-end. That’s because there are a number of tax-smart strategies you can implement now that may reduce your tax bill come April 15 or in the years ahead.

Consider how the following strategies might help to lower your taxes.

Put Losses to Work

If you have capital gains, IRS rules allow you to offset your gains with capital losses. Short-term gains (on assets held one year or less) are reduced by short-term losses, and long-term gains (on assets held longer than a year) are reduced by long-term losses. If your net long-term capital gain is more than your net short-term capital loss, the net capital gain generally is taxed at a top rate of 20%.1 A net short-term capital gain, on the other hand, is taxed at ordinary rates, which range as high as 37%. To the extent that losses exceed gains, you can deduct up to $3,000 in capital losses against ordinary income on that year’s tax return and carry forward any unused losses for future years.

Given these rules, there are several actions you should consider:

- Avoid short-term capital gains when possible, as these are taxed at higher ordinary rates. Unless you have short-term capital losses to offset them, consider holding the assets until you’ve met the long-term holding period (generally, more than one year).

- Take a good look at your portfolio before year-end and estimate your gains and losses. Some investments, such as mutual funds, incur trading gains or losses that must be reported on your tax return and are difficult to predict. But most capital gains and losses will be triggered by the sale of the asset, which you usually control. Are there some winners that have enjoyed a run and are ripe for selling? Are there losers you would be better off liquidating? The important point is to cover as many of the gains with losses as you can, thereby minimizing your capital gains tax.

- Consider taking capital losses before capital gains, since unused losses may be carried forward for use in future years, while gains must be taken in the year they are realized.

When determining whether or not to sell a given investment, keep in mind that a few down periods don’t mean you should sell simply to realize a loss. Stocks in particular are long-term investments, subject to ups and downs. Likewise, a healthy unrealized gain does not necessarily mean an investment is ripe for selling. Remember that past performance is no indication of future results; it is expectations

for future performance that count. Moreover, taxes should be only one consideration in any decision to sell or hold an investment.

IRAs: Contribute, Distribute, or Convert

One simple way of reducing your taxes is to contribute to a traditional IRA, if you are eligible for tax-deductible contributions. Contribution limits for the 2019 tax year — which may be made until April 15, 2020 — are $6,000 per individual and $7,000 for those aged 50 or older. Note that deductibility phases out above certain income levels, depending upon your filing status and whether you (or your spouse) are covered by an employer-sponsored retirement plan.

An important year-end consideration for older IRA holders is whether or not they have taken required minimum distributions. The IRS requires account holders aged 70½ or older to withdraw specified amounts from their traditional IRA each year. These amounts vary depending on your age. If you have not taken the required distributions in a given year, the IRS will impose a 50% tax on the shortfall. So make sure you take the required minimums for the year.

Another consideration for traditional IRA holders is whether to convert to a Roth IRA. If you expect your tax rate to increase in the future — either because of rising earnings or a change in tax laws — converting to a Roth may make sense, especially if you are still a ways from retirement. You will have to pay taxes on any pretax contributions and earnings in your traditional IRA for the year you convert, but withdrawals from a Roth IRA are tax free and penalty free as long as you’re at least 59½ and at least five years have passed since you first opened a Roth IRA. If you have a nondeductible traditional IRA (i.e., your contributions did not qualify for a tax deduction because your income was not within the parameters established by the IRS), investment earnings will be taxed but the amount of your contributions will not. The conversion will not trigger the 10% additional tax for early withdrawals.

These are just steps you can take today to help lighten your tax burden. Work with a financial professional and tax advisor to see what you can do now to reduce your tax bill.

1A 3.8% tax on net investment income may effectively increase the top rate on long-term capital gains to 23.8% for single taxpayers with a modified adjusted gross income (MAGI) of more than $200,000 and to those who are married and filing jointly with a MAGI of more than $250,000.

The Secure Act: Easier and More Flexible Ways to Save for Retirement

Americans are woefully unprepared for retirement. As survey after survey has shown, the average person is simply not

saving enough to provide for a comfortable retirement. That’s why Congress is currently proposing reforms to retirement

plan rules.

The House bill, dubbed the SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019), and the

Senate bill named RESA (Retirement Enhancement Savings Act) contain a number of different provisions designed to make

plans more accessible and flexible for savers and easier for small businesses to form and administer.

Below is a summary of the legislation’s most significant changes and how they will help more Americans save more for

retirement.

Access for part-time employees. The new rules would permit most long-term, part-time workers to participate in their employer’s retirement plan if they have worked at least 500 hours per year for three consecutive years. Additionally, employers would not be required to make employer contributions for these participants.

Longer time to contribute. Although Roth individual retirement accounts (IRAs) have no contribution time limit, contributions to traditional IRAs are not permitted after you reach age 70½. The legislation would repeal this age limit so that people working past age 70½

could contribute to both types of IRAs if they wish.

Later required minimum distributions (RMDs). Currently, plan participants and traditional IRA owners are generally required to start

withdrawing a minimum amount from their retirement savings each year once they reach age 70½. The new rules would increase this

age to 72, allowing savers to enjoy tax-deferred compounding even longer.

Penalty-free withdrawals for birth or adoption of child. This change would allow plan participants to withdraw up to $5,000, penalty

free, from their plan accounts following the birth or adoption of a child. Withdrawn amounts could later be recontributed to the plan

tax free, subject to certain requirements.

Improved portability of lifetime income. For participants whose plan gives them a lifetime income investment option — typically an

annuity — the legislation gives them the ability to either keep the annuity or roll it into an IRA or other qualified plan in the event that

the annuity option is removed from the plan’s investment lineup. The annuity would not have to be liquidated and the guarantees

would be preserved, allowing greater portability.

No more “stretch” IRAs for non-spouse beneficiaries. Current rules allow most IRA beneficiaries to “stretch” RMDs from an inherited account over their own lifetimes. The proposed rules would continue this feature for spouses, but non-spouse beneficiaries

would need to take distributions within 10 years of the IRA owner’s death. There would be some exceptions to the general rule,

however, if the beneficiary is a minor, disabled, chronically ill, or not more than 10 years younger than the deceased IRA owner.

Multiple employer plans (MEPs). The legislation would allow employers to combine forces with other unrelated employers to form

a MEP. This provision is aimed specifically at small businesses that otherwise could not offer a 401(k) to their employees due to

their high administrative costs.

A number of additional provisions target small businesses, making it easier to start and administer a retirement plan. These include

tax credits and other changes intended to reduce the amount of paperwork and costs associated with creating and maintaining a

retirement plan.

The legislation still needs to clear several hurdles in Congress before it can be signed into law. But it has bipartisan support in the

House and Senate, and the president is expected to sign it once a final bill is agreed upon. So stay tuned. A more SECURE retirement may soon be in your future.

Sources:

https://www.congress.gov/bill/116th-congress/house-bill/1994/text

https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/SECURE%20Act%20section%20by%20section.pdf

https://www.finance.senate.gov/imo/media/doc/RESA%20Summary%204.1.19-banner-converted.pdf

https://www.congress.gov/bill/116th-congress/house-bill/1007/text

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2019 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. This article was prepared by DST Systems Inc. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Please consult me if you have any questions. LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

Retiring? Take Control of Your Assets

After years of saving and investing, you can finally see the big day — retirement. But before kicking back, you still need to address a few matters. Decisions made now could make the difference between your money outlasting you or vice versa.

Calculating Your Retirement Needs

First, figure out how much income you may need. When retirement was years away, this exercise may have involved a lot of estimates. Now, you can be more accurate. Consider the following factors:

- Your home base — Do you intend to remain in your current home? If so, when will your mortgage be paid? Will you sell your current home for one of lesser value, or “trade up”?

- The length of your retirement — The average 65-year-old man can expect to live about 17 more years; the average 65-year-old woman, 20 more years, according to the National Center for Health Statistics. Have you accounted for a retirement of 20 or more years?

- Earned income — The Bureau of Labor Statistics estimates that by 2022, 23% of people aged 65 or older will still be employed, almost twice the proportion that prevailed in 2002.1 If you continue to work, how much might you earn?

- Your retirement lifestyle — Your lifestyle will help determine how much preretirement income you’ll need to support yourself. A typical guideline is 60% to 80%, but if you want to take luxury cruises or start a business, you may well need 100% or more.

- Health care costs and insurance — Many retirees underestimate health care costs. Most Americans are not eligible for Medicare until age 65, but Medicare doesn’t cover everything. You can purchase Medigap supplemental health insurance to cover some of the extras, but even Medigap insurance does not pay for long-term custodial care, eyeglasses, hearing aids, dental care, private-duty nursing, or unlimited prescription drugs. For more on Medicare and health insurance, visit Medicare’s consumer website.

- Inflation — Although the inflation rate can be relatively tame, it can also surge. It’s a good idea to tack on an additional 4% each year to help compensate for inflation.

Running the Numbers

The next step is to identify all of your potential income sources, including Social Security, pensions, and personal investments. Don’t overlook cash-value life insurance policies, income from trusts, real estate, and the equity in your home.

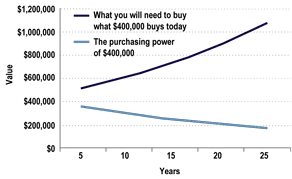

Also review your asset allocation — how you divide your portfolio among stocks, bonds, and cash. Are you tempted to convert all of your investments to low-risk securities? Such a move may place your assets at risk of losing purchasing power due to inflation. You may live in retirement for a long time, so try to keep your portfolio working for you — both now and in the future. A financial advisor can help you determine an appropriate asset allocation.

Robber Baron: Inflation |

| Here’s how a 4% inflation rate would erode $400,000 over a 25-year period. Because inflation slowly eats away at the purchasing power of a dollar, it’s important to factor inflation into your annual retirement expenses. |

|

This example is hypothetical and for illustrative purposes only. |

A New Phase of Financial Planning

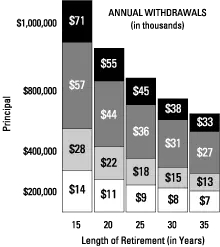

Once you’ve assessed your needs and income sources, it’s time to look at cracking that nest egg you’ve built up. First, determine a prudent withdrawal rate. A common approach is to liquidate 5% of your principal each year of retirement; however, your income needs may differ.

Next, you’ll need to decide when to tap into tax-deferred and taxable investments. The advantage of holding on to tax-deferred investments (employer-sponsored retirement plan assets, IRAs, and annuities) is that they compound on a before-tax basis and therefore have greater earning potential than their taxable counterparts.2 However, earnings and deductible contributions in tax-deferred accounts are subject to income tax upon withdrawal — a tax that can be as high as 39.6% at the federal level. In contrast, long-term capital gains from the sale of taxable investments are taxed at a maximum of 20%.3 The key to managing taxes is to determine the best strategy given your income needs and tax bracket.

Also, tax-deferred assets are generally subject to required minimum distributions (RMDs) — based on IRS life expectancy tables — after you reach age 70½. Failure to take the required distribution can result in a penalty equal to 50% of the required amount. Fortunately, guidelines do not apply to Roth IRAs or annuities.2 For more information on RMDs, see the IRS’s RMD resource page or call the IRS at 1-800-829-1040.

A Lifelong Strategy

A carefully crafted retirement strategy also takes into account your estate plan. A will is the most basic form of an estate plan, as it helps ensure that your assets get disbursed according to your wishes. Also, make sure that your beneficiary designations for retirement accounts and life insurance policies are up-to-date.

If estate taxes are a concern, you may want to consider strategies to help manage income while minimizing your estate tax obligation. For example, with a grantor retained annuity trust (GRAT), you move assets to an irrevocable trust and then receive an annual annuity for a specific number of years. At the end of that period, the remaining value in the GRAT passes to your beneficiary — usually your child — generally free of gift taxes. Another option might be a charitable remainder trust, which allows you and/or a designated beneficiary to receive income during life and a tax deduction at the same time. Ultimately, the assets pass free of estate taxes to a named charity.

It’s easy to become overwhelmed by all the financial decisions that you must make at retirement. The most important part of the process is to consult a qualified financial professional, a tax advisor, and an estate-planning attorney to make sure that you’re prepared for this new — and exciting — stage of your life.

How Much Can You Withdraw? |

| This chart can give you an idea how much you could potentially withdraw from your retirement savings each year. For example, if you begin with $400,000 in assets and expect an average annual return of 5% over a 25-year retirement, you could potentially withdraw $18,000 per year. Withdraw more than that each year and you may outlive your money. Also consider: This chart doesn’t take income taxes into account, which can range from 10% to 35%, depending on your tax bracket. |

|

Assumes 5% average annual return, and that withdrawal rate is adjusted for annual 4% inflation rate after the first year. This example is hypothetical and for illustrative purposes only. Investment returns cannot be guaranteed. |

1Source: Labor Force Projections to 2022, Monthly Labor Review, U.S. Bureau of Labor Statistics.

2Withdrawals from tax-deferred accounts prior to age 59½ are taxable and may be subject to a 10% additional tax. Neither fixed nor variable annuities are insured by the Federal Deposit Insurance Corp., and they are not deposits of — or endorsed or guaranteed by — any bank. Withdrawals from annuities may result in surrender charges.

3A 3.8% tax on unearned income may also apply.

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2017 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.

Income Investing? Think Dividends

It used to be, investors seeking steady income turned exclusively to bonds, whose regular interest payments provided a dependable income source, especially for retirees.

But times have changed. With many retirements today lasting 30 years or more, income investors need to make sure their savings keep pace with inflation and last a long time. This means investing in assets that provide current income, yet have the potential to grow in value and yield over time.

One widely used strategy is to include dividend-paying stocks in your portfolio. History provides compelling evidence of the long-term benefits of dividends and their reinvestment:

- Dividends are a sign of corporate financial health. Dividend payouts are often seen as a sign of a company’s financial health and management’s confidence in future cash flow. Dividends also communicate a positive message to investors who perceive a long-term dividend as a sign of corporate maturity and strength.

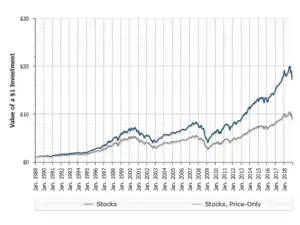

- Dividends are a key driver of total return. There are several factors that may contribute to the superior total return of dividend-paying stocks over the long term. One of them is dividend reinvestment. The longer the period during which dividends are reinvested, the greater the spread between price return and dividend reinvested total return.

- Dividend payers offer potentially stronger returns, lower volatility. Dividends may help to mitigate portfolio losses when stock prices decline, and over long time horizons, stocks with a history of increasing their dividend each year have also produced higher returns with less risk than non-dividend-paying stocks. For instance, for the 10 years ended June 30, 2019, the S&P 500 Dividend Aristocrats — those stocks within the S&P 500 that have increased their dividends each year for the past 25 years — produced average annualized returns of 16.3% vs. 14.7% for the S&P 500 overall, with less volatility (11.7% vs. 12.7%, respectively).1

- Dividends benefit from potentially favorable tax treatment. Most taxpayers are subject to a top federal tax rate of only 15% on qualified dividends, although certain high-income taxpayers may pay up to 23.8%. However, that is still lower than the current 37% top rate on ordinary income.

- Dividend-paying stocks may help diversify an income-generating portfolio. Income-oriented investors may want to diversify potential sources of income within their portfolios.

Stocks with above-average dividend yields may compare favorably with bonds and may act as a buffer should conditions turn negative within the bond market.

Dividends Can Boost Total Return2

If you are considering adding dividend-paying stocks to your investment mix, keep in mind that they generally carry higher risk than bonds. Stock investing involves the potential for loss of principal. Also, dividends can be increased, decreased, and/or eliminated at any time without prior notice. That’s why it’s important to choose your dividend-paying stocks carefully, since some companies may increase dividends to attract investors if their finances aren’t watertight or their outlook is cloudy.

Your financial professional can help you determine if dividend-paying stocks are a good fit for your portfolio.

1Source: DST Systems, Inc., based on data from Standard & Poor’s. Volatility is measured by standard deviation. Standard deviation is a historical measure of the variability of returns relative to the average annual return. If a portfolio has a high standard deviation, its returns have been volatile. A low standard deviation indicates returns have been less volatile. Past performance is no guarantee of future results.

2Source: ChartSource®, DST Systems, Inc. For the period from January 1, 1989, through December 31, 2018. Stocks are represented by the S&P 500 index. Stock prices are represented by the change in price of the S&P 500 index. It is not possible to invest directly in an index. Index performance does not reflect the effects of investing costs and taxes. Actual results would vary from benchmarks and would likely have been lower. Past performance is not a guarantee of future results. © 2019, DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions. (CS000080)

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2019 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. This article was prepared by DST Systems Inc. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Please consult me if you have any questions. LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

Lowering Your Tax Bill with an HSA — Today and in Retirement

For years, Americans have been schooled on the benefits of saving: for retirement, for a child’s higher education, and even for a rainy day. It’s time to add another item to that list: health care. As health insurance premiums, deductibles, and co-pays rise, the need to set aside funds specifically for medical costs has become a reality for a growing number of people.

Enter the health savings account (HSA). Created in 2003, HSAs are special savings accounts that can be used to pay for out-of-pocket health care costs. Contributions are generally tax deductible and withdrawals for qualified costs are tax free. What’s more, since un-used balances can be carried over from year to year, they can be used to fund health care costs today and in retirement.

But some restrictions do apply. Here is a summary of HSAs and their different features.

Eligibility

You can open an HSA, whether through your employer or on your own, provided you:

- Are currently covered by an HSA-qualified high-deductible health plan (HDHP).* For 2019, that deductible must be at least $1,350 for single coverage and $2,700 for family coverage;

- Do not have other health coverage (although certain types of insurance are allowed, such as dental and vision care);

- Cannot be claimed as a dependent on someone else’s tax return; and

- Are not enrolled in Medicare.

Contributions

Your contributions to an HSA are tax deductible and there are no income or phase-out restrictions. Employers can make nontaxable contributions on behalf of their employees. But the annual limits listed below still apply.

- For 2019, singles can contribute up to $3,500 and families can sock away $7,000.

- If you’re 55 or older anytime in 2019, you can contribute an extra $1,000.

Contribution limits are adjusted annually for inflation.

Withdrawals

You can tap into your HSA tax and penalty free to pay for any “qualified medical expense” incurred on behalf of you, your spouse, or your dependents. Below is a partial list. See this IRS webpage for more detail on qualified expenses.

Qualified expenses:

- Preventative care, including doctor visits and screening services

- Prescriptions

- Dental care

- Vision care

Unqualified expenses:

- Insurance premiums (limited exceptions apply)

- Non-prescription drugs (except insulin)

- Expenses incurred before you establish your HSA

Note that any withdrawals that aren’t for qualified medical expenses are taxable and may be subject to an additional 20% tax.

Additional Features

HSAs can be invested in a variety of different vehicles, and interest accumulates tax free. What’s more, HSA funds never ex-pire. You can carry over unused balances from year to year. And if you leave your job, your HSA goes with you.

Once you reach Medicare eligibility age (currently age 65), you can take withdrawals from your account for any reason with-out penalty, not just for medical expenses. But be warned: If not used for medical care, withdrawals are no longer federally (and in some cases, state) tax free.

Upon your death, your HSA can be passed along to your surviving spouse. Unmarried individuals can pass the account to their beneficiary or estate; however, applicable taxes will apply.

*Footnotes/Disclaimers

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guar-antees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential dam-ages in connection with subscriber’s or others’ use of the content.

© 2019 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any er-rors or omissions. The opinions voiced in this material are for general information only and are not intended to provide specific advice or rec-ommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. This article was prepared by DST Systems Inc. The opinions voiced in this material are for general infor-mation only and are not intended to provide specific advice or recommendations for any individual. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Please consult me if you have any questions. LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

How Much Social Security Can You Expect?

One of the first steps in planning for retirement is to get an accurate read on just how much income you can expect to receive from Social Security. The exact amount of your Social Security benefit will depend upon your earnings history and retirement timing. Although Social Security provides only about a third of a typical retiree’s income, it often serves as the foundation for calculating how much other income you’ll need and how much you’ll need to save.

The best and most accurate estimate of your future Social Security benefits comes from the Social Security Administration (SSA). If you are age 60 or older, you should be automatically sent an annual statement showing exactly how much you can expect when you retire. If you are under age 60, you can access current estimates through the SSA’s My Social Security site. You can also access SSA’s online calculators.

Here is a summary of the different ways you can get accurate estimates of your Social Security:

- Social Security Statements are mailed annually to anyone age 60 or older who has paid into Social Security. The statements include an estimate of your monthly benefit at full retirement age, based on your earnings history. They also show your earnings history – a year-by-year breakdown of earnings on which benefits are based. You can also request a statement by creating a personal my Social Security account. Once it’s set up, you can easily access updates and view your earnings history. You can also request a statement at any time by calling 1-800-772-1213 or contacting your local SSA office.

- Retirement Estimator gives estimates based on your actual Social Security earnings record. The calculator shows results for early (age 62), full (ages 65-67 depending upon your year of birth), and delayed (age 70) retirement. The Retirement Estimator also lets you create additional “what if” retirement scenarios based on current law.

- Other SSA benefit calculators help you estimate your Social Security benefits if you do not have an earnings record with Social Security or cannot access it. The calculators will show your retirement benefits as well as disability and survivor benefit amounts if you should become disabled or die. A variety of calculators are available that address different circumstances.

|

How much also depends on when you start collecting

If you want, you can sign up for Social Security benefits at age 62. However, you’ll receive less than your full benefit — somewhere between 70% and 75% — depending on when you were born. What’s more, if you are still working and make more than the yearly earnings limit ($17,640 in 2019), your benefit will be reduced by one dollar for every two dollars earned beyond that limit.

Wait until full retirement age (from 66 to 67 for those born after 1942) and you’ll receive your full benefit and face no earnings penalty. Sign up for benefits beyond full retirement age and your benefit will increase 8% a year until you reach age 70.

When you decide to collect will depend in part on how much you can expect to receive. So make a point of checking out one of the resources above.

1Source: Social Security Administration OIG, Issuance of Social Security Statements, February, 2019.

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2019 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. This article was prepared by DST Systems Inc. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Please consult me if you have any questions. LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Good Window of Opportunity for Roth IRA Conversions

The Roth IRA is a powerful tax-favored retirement option since it can offer a hedge against future tax-rate increases. But beyond tax planning considerations,

Roth IRAs have several important advantages over traditional IRAs:

- Unlike a traditional IRA, a Roth IRA distribution is tax-free if you’ve had the account open at least five years, and reached the age of 59½, become disabled or died.

- You can make contributions to your Roth IRA after age 70½, depending on whether you fall within the earned income limits.

- Roth IRAs are not subject to the traditional IRA rules for required minimum distributions at age 70½.

The Internal Revenue Code allows IRA owners to convert significant sums from traditional IRAs to Roth IRAs. But you have to follow these important rules (among others):

- The ability to contribute tails off at higher incomes. For 2019, the eligibility to make annual Roth IRA contributions is phased out between modified adjusted gross income (MAGI) levels of $122,000 to $137,000 (unmarried individuals) and $193,000 to $203,000 (married joint filers).1

- The conversion is treated as a taxable distribution from your traditional IRA. Doing a conversion likely will trigger a bigger federal income tax bill and possibly a larger state income tax bill. However, today’s lower federal income tax rates might be the lowest you’ll see in your lifetime, and the tax benefits of avoiding higher taxes in future years may extend to family members after death.

Many tax experts suggest that the best reason to convert some or all of your traditional IRA to a Roth IRA is if you believe your tax rate during retirement will be the same or higher than what you are paying currently. Since you’re no longer allowed to reverse a Roth IRA conversion, it’s important to understand the tax ramifications. Talk to your tax advisor before taking any action.

Traditional vs. Roth IRA: High-level Comparison

Here is a simplified comparison of IRA rules and tax benefits. Remember, tax laws are complex and subject to change. Consult a tax advisor about your individual situation before taking action.

| Traditional IRA | Roth IRA | |

| Age limits for contributing | You must be under 70½ to contribute. | You can contribute to a Roth IRA at any age. |

| Income limits for contributions | Your contributions can’t exceed the amount of income you earned in that year or other IRS-imposed limits. | Your contributions can’t exceed the amount of income you earned in that year or other IRS-imposed limits, and can be reduced or eliminated based on your modified adjusted gross income. |

| 2019 tax-year contribution limits | If you are under age 50, you can contribute up to $6,000. If you are older than age 50, you can contribute $7,000. (Limits can be lower based on your income.) | If you are under age 50, you can contribute up to $6,000. If you are older than age 50, you can contribute $7,000. (Limits can be lower based on your income.) |

| Claiming deductions on tax return | You may be able to claim all or some of your contributions. | You cannot deduct your Roth IRA contribution. |

1 Source: Bill Bischoff, “How the new tax law created a ‘perfect storm’ for Roth IRA conversions in 2019,” MarketWatch.com, Jan. 16, 2019. https://www.marketwatch.com/story/how-the-new-tax-law-creates-a-perfect-storm-for-roth-ira-conversions-2018-03-26

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. LPL Financial and its advisors are providing educational services only and are not able to provide participants with investment advice specific to their particular needs. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own, separate from this educational material.

Kmotion, Inc., 412 Beavercreek Road, Suite 611, Oregon City, OR 97045; www.kmotion.com

© 2019 Kmotion, Inc. This newsletter is a publication of Kmotion, Inc., whose role is solely that of publisher. The articles and opinions in this publication are for general information only and are not intended to provide tax or legal advice or recommendations for any particular situation or type of retirement plan. Nothing in this publication should be construed as legal or tax guidance; nor as the sole authority on any regulation, law or ruling as it applies to a specific plan or situation. Plan sponsors should consult the plan’s legal counsel or tax advisor for advice regarding plan-specific issues.