Think Twice Before Tapping into Your Retirement Savings

New legislation — the CARES Act — permits qualified individuals to take early distributions from their retirement assets, such as their 401(k) or individual retirement account (IRA) — penalty free. The rules – which sunset after 2020 – are designed to help the many cash-strapped Americans who have suffered financially as a result of the coronavirus epidemic. But tapping into your retirement savings has its costs, and there may be better ways to shore up your short-term cash flow.

The CARES Act

The Act permits qualified individuals to take distributions of up to $100,000 from their IRA or workplace retirement savings plan (if allowed by the plan) without incurring the 10% additional tax on early distributions that would otherwise generally apply to distributions made prior to age 59½. Amounts withdrawn may be repaid within three years, if desired. Note, however, that ordinary income taxes apply to all pretax funds withdrawn, although taxpayers may elect to report the income over three tax years instead of one.

These coronavirus-related distributions may only be made to a “qualified individual” on or after January 1, 2020, and before December 31, 2020. A qualified individual includes anyone who has been diagnosed with the SARS-CoV-2 virus or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention, or whose spouse or dependent has been diagnosed. It also includes individuals who experience adverse financial consequences as a result of: being quarantined, furloughed, laid off, or having work hours reduced due to SARS-CoV-2 or COVID-19; being unable to work on account of a lack of childcare due to the virus or disease; closing or reducing hours of a business owned or operated by the individual due to the virus or disease; or other factors as determined by the Treasury Secretary.

The Act also relaxes rules on borrowing from a retirement plan account. If authorized by the plan, qualified individuals may borrow as much as $100,000 or 100% of their vested account balance. These limits are effective from March 27, 2020 to September 22, 2020.

Additionally, qualified individuals with an outstanding loan (on or after March 27, 2020) may delay loan repayments due during the period from March 27, 2020 to December 31, 2020 for up to one year.

Consider the Costs

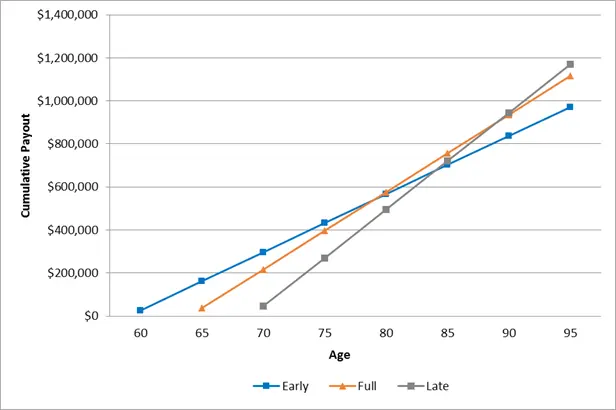

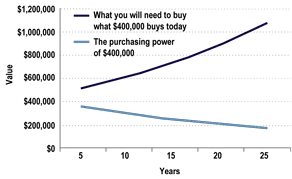

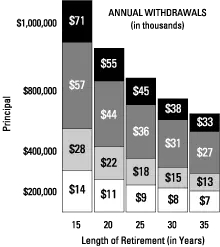

Withdrawing or borrowing money from your retirement account may seem like an easy way to shore up your short-term cash flow, but there are long-term costs to consider. Most notably, if you withdraw funds and don’t repay them, you’ll be reducing your retirement nest egg, perhaps significantly. And making up for withdrawn balances means contributing more — potentially much more — down the road. That’s because time is a critical ally when saving for retirement. The more time your contributions and earnings have to grow, the better the chance you will be able to reach your retirement savings goals.

If you don’t withdraw the funds altogether, but just borrow them from your plan, you must generally pay back the loan within five years, or earlier if you lose your job or leave your employer voluntarily before the loan is paid back. Otherwise, it will be considered a taxable distribution, requiring you to pay income tax on the amount of the loan. What’s more, current law protects funds held in a qualified plan from creditors in the event of a bankruptcy. So if you are experiencing extreme financial difficulty, keeping funds in your qualified plan may be one way to limit the damage. Even if you’re allowed to defer some loan payments because of the CARES Act, you’ll want to weigh the potential downsides before borrowing.

There May be Better Alternatives

As any financial professional will attest, borrowing from your future to fund today’s temporarily negative cash flow is generally not a good strategy. Instead, consider other sources of funds such as:

- Short-term loans

- Tapping into a home equity line of credit

- Borrowing from friends or relatives

You also may want to consider ways to reduce current costs until your cash flow improves.

- Reduce credit card payments by consolidating balances on a low-rate card

- Contact current lenders to arrange for a temporary payment freeze

- Cut back on discretionary expenses and make a budget

Also keep in mind that the provisions of the CARES Act are temporary. So if the economic fallout from the coronavirus epidemic has left you strapped for cash, try to maintain a long-term focus and stick to your plan.

This material was prepared by LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.