Retiring? Take Control of Your Assets

After years of saving and investing, you can finally see the big day — retirement. But before kicking back, you still need to address a few matters. Decisions made now could make the difference between your money outlasting you or vice versa.

Calculating Your Retirement Needs

First, figure out how much income you may need. When retirement was years away, this exercise may have involved a lot of estimates. Now, you can be more accurate. Consider the following factors:

- Your home base — Do you intend to remain in your current home? If so, when will your mortgage be paid? Will you sell your current home for one of lesser value, or “trade up”?

- The length of your retirement — The average 65-year-old man can expect to live about 17 more years; the average 65-year-old woman, 20 more years, according to the National Center for Health Statistics. Have you accounted for a retirement of 20 or more years?

- Earned income — The Bureau of Labor Statistics estimates that by 2022, 23% of people aged 65 or older will still be employed, almost twice the proportion that prevailed in 2002.1 If you continue to work, how much might you earn?

- Your retirement lifestyle — Your lifestyle will help determine how much preretirement income you’ll need to support yourself. A typical guideline is 60% to 80%, but if you want to take luxury cruises or start a business, you may well need 100% or more.

- Health care costs and insurance — Many retirees underestimate health care costs. Most Americans are not eligible for Medicare until age 65, but Medicare doesn’t cover everything. You can purchase Medigap supplemental health insurance to cover some of the extras, but even Medigap insurance does not pay for long-term custodial care, eyeglasses, hearing aids, dental care, private-duty nursing, or unlimited prescription drugs. For more on Medicare and health insurance, visit Medicare’s consumer website.

- Inflation — Although the inflation rate can be relatively tame, it can also surge. It’s a good idea to tack on an additional 4% each year to help compensate for inflation.

Running the Numbers

The next step is to identify all of your potential income sources, including Social Security, pensions, and personal investments. Don’t overlook cash-value life insurance policies, income from trusts, real estate, and the equity in your home.

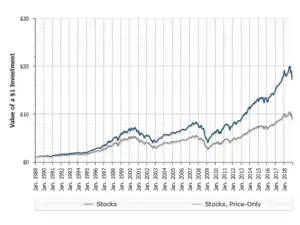

Also review your asset allocation — how you divide your portfolio among stocks, bonds, and cash. Are you tempted to convert all of your investments to low-risk securities? Such a move may place your assets at risk of losing purchasing power due to inflation. You may live in retirement for a long time, so try to keep your portfolio working for you — both now and in the future. A financial advisor can help you determine an appropriate asset allocation.

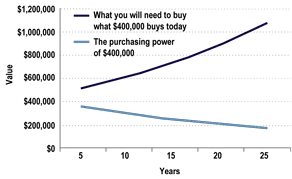

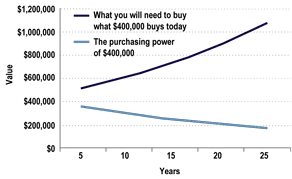

Robber Baron: Inflation

|

| Here’s how a 4% inflation rate would erode $400,000 over a 25-year period. Because inflation slowly eats away at the purchasing power of a dollar, it’s important to factor inflation into your annual retirement expenses. |

|

This example is hypothetical and for illustrative purposes only.

|

A New Phase of Financial Planning

Once you’ve assessed your needs and income sources, it’s time to look at cracking that nest egg you’ve built up. First, determine a prudent withdrawal rate. A common approach is to liquidate 5% of your principal each year of retirement; however, your income needs may differ.

Next, you’ll need to decide when to tap into tax-deferred and taxable investments. The advantage of holding on to tax-deferred investments (employer-sponsored retirement plan assets, IRAs, and annuities) is that they compound on a before-tax basis and therefore have greater earning potential than their taxable counterparts.2 However, earnings and deductible contributions in tax-deferred accounts are subject to income tax upon withdrawal — a tax that can be as high as 39.6% at the federal level. In contrast, long-term capital gains from the sale of taxable investments are taxed at a maximum of 20%.3 The key to managing taxes is to determine the best strategy given your income needs and tax bracket.

Also, tax-deferred assets are generally subject to required minimum distributions (RMDs) — based on IRS life expectancy tables — after you reach age 70½. Failure to take the required distribution can result in a penalty equal to 50% of the required amount. Fortunately, guidelines do not apply to Roth IRAs or annuities.2 For more information on RMDs, see the IRS’s RMD resource page or call the IRS at 1-800-829-1040.

A Lifelong Strategy

A carefully crafted retirement strategy also takes into account your estate plan. A will is the most basic form of an estate plan, as it helps ensure that your assets get disbursed according to your wishes. Also, make sure that your beneficiary designations for retirement accounts and life insurance policies are up-to-date.

If estate taxes are a concern, you may want to consider strategies to help manage income while minimizing your estate tax obligation. For example, with a grantor retained annuity trust (GRAT), you move assets to an irrevocable trust and then receive an annual annuity for a specific number of years. At the end of that period, the remaining value in the GRAT passes to your beneficiary — usually your child — generally free of gift taxes. Another option might be a charitable remainder trust, which allows you and/or a designated beneficiary to receive income during life and a tax deduction at the same time. Ultimately, the assets pass free of estate taxes to a named charity.

It’s easy to become overwhelmed by all the financial decisions that you must make at retirement. The most important part of the process is to consult a qualified financial professional, a tax advisor, and an estate-planning attorney to make sure that you’re prepared for this new — and exciting — stage of your life.

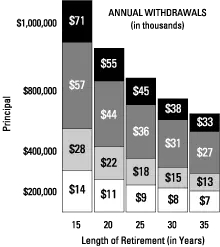

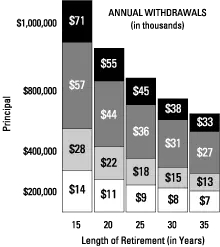

How Much Can You Withdraw?

|

| This chart can give you an idea how much you could potentially withdraw from your retirement savings each year. For example, if you begin with $400,000 in assets and expect an average annual return of 5% over a 25-year retirement, you could potentially withdraw $18,000 per year. Withdraw more than that each year and you may outlive your money. Also consider: This chart doesn’t take income taxes into account, which can range from 10% to 35%, depending on your tax bracket. |

|

Assumes 5% average annual return, and that withdrawal rate is adjusted for annual 4% inflation rate after the first year. This example is hypothetical and for illustrative purposes only. Investment returns cannot be guaranteed.

|

1Source: Labor Force Projections to 2022, Monthly Labor Review, U.S. Bureau of Labor Statistics.

2Withdrawals from tax-deferred accounts prior to age 59½ are taxable and may be subject to a 10% additional tax. Neither fixed nor variable annuities are insured by the Federal Deposit Insurance Corp., and they are not deposits of — or endorsed or guaranteed by — any bank. Withdrawals from annuities may result in surrender charges.

3A 3.8% tax on unearned income may also apply.

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber’s or others’ use of the content.

© 2017 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.